Nanotechnology has matured to the point where it provides exquisite solutions to key challenges across medicine and biology, as seen in the success of delivery nanovectors for COVID-19 vaccines. Among these nanotechnologies, nanoneedles — vertical arrays of high-aspect-ratio nanomaterials — have emerged as a simple, controllable and powerful tool to efficiently access cells with minimal perturbation. Nanoneedles are rapidly emerging as competitive solutions for sensing, and offer a path to transforming gene and cell therapies. Realizing the transformative potential of nanoneedles is a work in progress. In this Comment, we discuss the burgeoning advances and strong commercial activities of nanoneedle technology through the eyes of leading researchers, entrepreneurs and venture capitalists — all of them major players in the evolution of a viable nanoneedle technology for sensing and clinical use.

Why nanoneedles are hot science

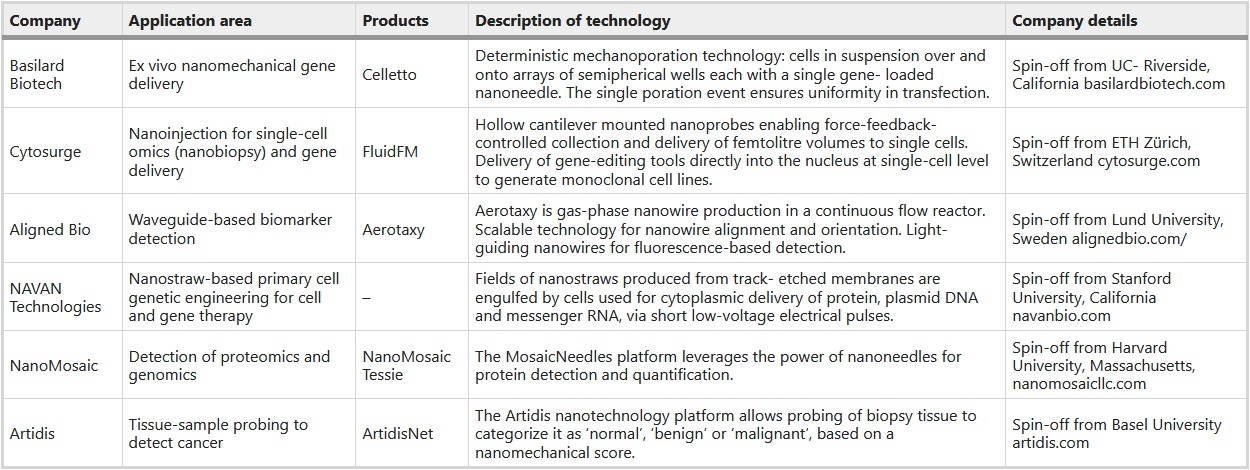

The cell is a crowded, dynamic environment, in which access and transport are highly regulated. Conventional intracellular delivery and sensing methods significantly perturb cell function, limiting their physiological relevance. The genius of nanoneedles is their capacity to gain access to many cell types many times with minimal and transient disruption, for efficient delivery of advanced therapeutics (nanoinjection) and non-destructive sampling of a cell’s state (nanobiopsy). Having shown their strengths in the lab, the commercial interest in nanoneedles has boomed, and has been captured by start-ups that are working to develop and implement nanoneedle products and services (Table 1).

Table 1 Details of companies commercializing nanoneedle technology for biomedical applications. Full size table

Capturing market opportunities for nanoneedle technology

Cell therapies

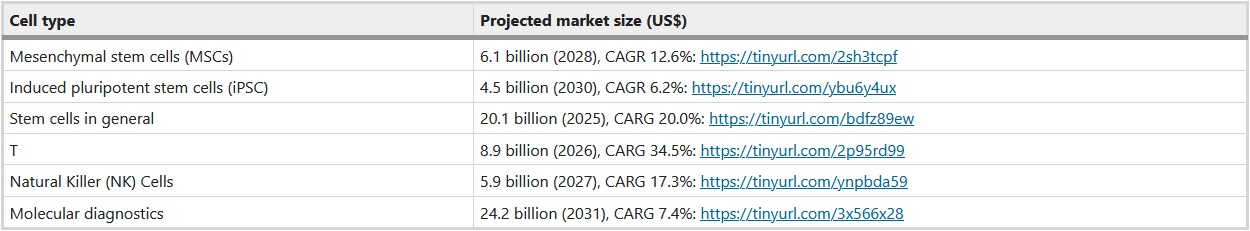

Re-engineering patients’ own cells to restore function and treat diseases is a major challenge in contemporary medicine. The scale of interest and investment in the cell therapy market is global, with a market size projected to expand at a compound annual growth rate (CAGR) of 14.5% from 2021 to 2028 (Table 2). We can now engineer cells and tissues that benefit patients, but their prohibitive costs and complexity make these advances inaccessible to almost everyone who needs them. The scalable, high-throughput genetic engineering required by cell therapies is poorly matched by their labour-, reagent- and energy-intensive processes, alongside low yields, high processing variability and limits in their capacity for gene editing. Nanoneedles and emerging nanoinjection modalities — such as nanoelectroporation, laser-assisted optoporation and mechanical force applications — are widespread routes for increasing cellular delivery efficacy (reducing cell manufacturing time and costs); these are set to broaden the modality and cellular targets of therapeutic delivery for in vivo and ex vivo gene therapy, chimeric antigen receptor (CAR) T-cell therapy, and stem and neural cell therapy, and are already pushing the limits of spatiotemporal intracellular resolution.

Table 2 Projected market size for each cell type. Full size table

Molecular diagnostics

Molecular diagnostics is the cornerstone of precision medicine: it offers accurate information on biological factors underlying a disease, broadening the scope of appropriate treatments. Most available molecular diagnostics tests are assays of individual biomarkers, small biomarker panels or genomic screening techniques. Yet these approaches often fail to properly capture molecular heterogeneity within tissues — allowing significant traits in many complex diseases to go undiagnosed. Nanoneedles could be a low-cost, high-throughput, high-sensitivity platform for spatial biology, through repeated non-destructive extraction of intracellular contents from the same cell population. Nanoneedles applied to tissues retrieve and preserve spatial molecular information without he need for a biopsy, making it possible to map the molecular composition of tissues — either in a biomarker-based approach or through spatial biology approaches. Applying nanoneedles to live biological systems permits longitudinal repeated sampling of molecular information with minimal disruption.

Motivation and challenges in setting up a university spin-off

What was then a radical idea — that nanoneedles would eventually transform gene delivery and intracellular sampling — arose less than two decades ago in a raft of proof-of-principle research papers. Moving from the earliest conceptual stage to technological maturity typically takes up to a decade. Cytosurge, an ETH Zürich spin-off founded in 2009, was the first company to market nanoneedles, and only recently put its new atomic force microscopy product, the FluidFM, on the market. Yet their first commercial cell-therapy application is still under development.

Bessemer Venture Partners has invested in more than 30 start-ups. Partner Adam Fisher says the journey from radical idea to proof of concept to the launch of a nanotech spin-off needs “a huge leap in the fundamental mindset of a researcher”.

Right from the get-go of a university–industry transition, researchers need to shift gear from lab research into commercial development. They need to ask themselves whether they have the right entrepreneurial mindset to balance their scientific vision, institutional accountability and translational strategy. According to Fisher, it is not easy for an academic to flip the switch from research to development, as the goals and the values of doing lab science — the drive, pace and rigour of research — are very different from those of development, where milestones and deliverables dominate. For Fisher, there are five critical questions to ask before taking the plunge by spinning off a nanotech enterprise: What value or benefit will it bring to the market? Do you understand the product (whether device, service, idea or intellectual property (IP))? How will you create and fund the spin-off? Who will be the target consumers? Who will be in your team?

Riding the start-up rollercoaster

Taking the first steps towards launching a university nanotech spin-off is a rollercoaster ride — a considerable departure from the fundamental research ecosystem. A successful nanotech spin-off needs to pull together five key elements, broadly correlating with Fisher’s five points above: (1) an exceptional technology with a market need; (2) IP management; (3) risk and capital investment, coupled with (4) a solid business strategy; and (5) a team with the right complementary skill sets.

Exceptional technology with a market need

Basilard BioTech, a spin-off from the University of California (UC) Riverside, sees their ‘deterministic mechanoporation’ technology as the turning point of their gene-delivery innovation, in which each cell is ‘poked’ by nanomechanical element (a silicon nanoneedle) just once, not indiscriminately. This reproducible mechanical poration by a single needle on a single cell in the same location promises more uniform, reliable and less-disruptive delivery of genetic material — a much-needed goal for CAR T-cell technology. Co-founders Professor Masaru Rao and Mr Brynely Lee see their technology as having a dramatic impact on cellular immunotherapies, in particular CAR T-cell therapy.

Cytosurge is actively developing hollow FluidFM nanoprobes, enabling precise control of femtolitre volumes for intracellular delivery and nanobiopsy. The technology originated from Professor Tomaso Zambelli’s group at ETH Zürich, and was then developed by Dr Pascal Behr (Cytosurge’s chief executive officer (CEO) and co-founder) during his PhD. Behr realized that there was a market need for FluidFM from the sheer number of researchers approaching him to access these specialized engineered nanoprobes. The biggest scientific challenge for the spin-off was to figure out how FluidFM could robustly bridge the nanotechnological and biological worlds that are “both inherently so far apart”. “Bridge is just one simple word,” Zambelli says, “but it took us 10 years of work.”

Aligned Bio, a spin-off from Lund University, is targeting next-generation DNA sequencing and molecular biomarker detection. For biomarkers, they are already licensing their nanoneedle platforms and moving towards full solutions for point of care and diagnostics. The technology for DNA sequencing is under development, having demonstrated single-molecule and dye identification at the speeds and costs of single-molecule sequencing.

Developing intellectual property

IP is critical and expensive. Behr says that Cytosurge negotiated friendly IP terms with ETH Zürich’s transfer office, obtaining an exclusive license agreement. Over the 12 years since launching, IP security has become increasingly important to the business. Online-based stealing of IP is a factor to consider when expanding IP protection: developmental urgency must be balanced against the costs of protection — which might be trivial for big multinational companies but is often significant for a small spin-off. Mr Erik Smith (CEO, founder and board member of Aligned Bio) says that protecting IP is essential, and should not be sacrificed because of costs; but at the same time, IP protection is no guarantee of commercial success. That is how IP is presented to potential investors.

Management of IP varies among universities. How much ownership and prospective revenue the university will retain is usually subject to intense negotiation with a spin-off or start-up, in the absence of a consistent framework. The Melbourne Centre for Nanofabrication (MCN) — headquarter of the Australian government-funded Australian National Fabrication Facility, which supports many Australian universities, government labs and private companies with International Organization for Standardization-accredited micro- and nanofabrication capabilities — is taking a unique approach. Dr Langelier (MCN’s general manager) explains that MCN allows academic and industry clients to retain all IP generated. This is specifically designed to help researchers to traverse the so-called valley of death — a challenging period in a product’s development life cycle in which things such as IP ownership, scalability and access to capital are put to the test. Such arrangements, at least in the case of the MCN, have helped to create a vibrant environment for university spin-offs, start-ups and established companies. Each year the facility hosts more than ten full-time industry residents, who view the MCN as an extension of their own laboratories.

Capital investment and risk

Medtech markets for nanoneedle technologies are all young and still open to disruptive innovations that will improve efficiency and/or reduce costs; yet the value of these markets and their projected growth is already significant (for example, Nanomosaic’s first series was oversubscribed at more than US$40.75 million in early 2022) — a promise of long-term sustainability if the technology can be established. The right type of fundraising approach is vital in achieving this.

Fundraising is usually a multi-stage process, especially for nanotech spin-offs. Despite strong financial support by universities to initially create the technology, with sometimes co-investment from governments or philanthropists, this model does not usually extend to the next stage of riskier capital investment. Unlike IT spin-offs, with their often rapid and relatively inexpensive paths to market, nanotech spin-offs have a much higher bar: when it comes to nanoneedles, some investors may be wary of medtech applications, which are subject to regulatory issues around patient safety concerns. This makes it much more intricate to calculate risk, revenue, time to market, and time to reach a liquidity event such as a merger, acquisition or initial public offering. So it is typically more challenging to secure substantial funding or give investors confidence in offering tenfold returns on investment over five years, or fivefold returns over three years — the standard expectations of venture capitalists (VCs).

Basilard Biotech, for example, was born of the quest to minimize risk by identifying the most compelling and viable technology at UC Riverside — a task the university assigned to Lee as its CEO-in-residence. He gauged the readiness of more than 50 technologies, narrowing the field to those most likely to attain market traction, raise capital and attract customer partnerships. Essentially, he says, the challenge was “to find the one technology; and now we have Basilard”. The innovation pipeline at UC Riverside is closely tracked by the California-based Vertical Venture Partners, which manages the University’s Highlander Venture Fund that was set up in 2017. The company made an initial US$500,000 investment in Basilard that pushed their nanoneedle technology to early-stage milestones, and then to the translational stage.

The due diligence of evaluating Cytosurge’s IP portfolio as a whole gave the company the freedom to operate and secure capital investment in the millions from Swiss angel investors (who put their private money into higher-risk early-stage companies. “These people, in this case friends and family, made our first five years possible,” says Behr. Continued streamlined investments have allowed Cytosurge to grow and diversify technology, such as a new gene editing service (FluidFM CellEDIT), and build the business to the point where it has spawned another start-up.

Aligned Bio followed a more established path, raising Swedish seed and innovation funds in September 2019 to gain 80 provisional or full patents. With IP secured, they engaged immediately with customers and attracted staff with the talent to innovate. Through technology demonstrations and customer interactions, they managed to raise about five times the company’s valuation in December 2020. The company has also been successful at securing grants as a part of its funding strategy, such as US$2.4 million from the European Innovation Council in 2021.

Fisher thinks it is possible to invest in entrepreneurs who lack experience, but these individuals must demonstrate a good sense of what the customer needs and how to reflect these needs in technology development. There are diverse sources and routes for raising investment (for example, angel investors and VCs), but entrepreneurs should ultimately focus on finding the right type of investors who share their vision and believe in their technology.

Solid business strategy

A solid business plan and clear path to profitability is often the first thing that prospective investors will look at. Basilard has developed its business plan by building credibility and traction in the investment community, and are nearing the close of their seed-capital round from a syndicate of early-stage VC and angel groups. “Once the first VC company was convinced, there was a level of validation that reduced risk and helped encourage others to invest.” Lee highlights the importance of identifying and determining a strong beachhead strategy. Basilard has generated interest from a broad range of biotech and big pharma companies — specifically in the CAR T-cell market and more broadly in the ex vivo cell- and gene-therapy markets. It has been critical for Basilard to measure and understand the performance metrics of its product, and to adapt it to the specific needs of cell- and gene-therapy companies. For some companies, scalability (involving the number of cells and the throughput) is the biggest hurdle; for others, the focus is on transfection performance; and for others, the goal is to deliver molecular constructs of specific size or to look at combining all of these metrics.

Cytosurge sold its unique atomic force microscopy hollow probe right from the early stages. Behr says Cytosurge had a profitable margin from the start, allowing them to operate at a small scale for several years. Then Cytosurge accessed Swiss National Science Foundation funding, which enabled ETH Zürich and the company to share PhD students. This was important in developing FluidFM at reasonable cost. Cytosurge’s initial idea was to manufacture only hollow FluidFM nanoprobes, but at a certain stage they made the decision to design their own atomic force microscopy instruments, decoupling from external tool manufacture to exercise closer control over the process. Cytosurge technology was so versatile and disruptive that it gave birth to another spin-off, Exaddon, which now specializes in three-dimensional electrochemical metal microprinting.

A team with the right complementary skill sets

Smith compares a good company to a successful sport team: “Winning championships needs teamwork combining specific skill sets.” At Aligned Bio, all players — scientists, technicians and administrators — learn the fundamental concepts of business. His view is that “even though we’re a technology/science-based company, we’re first and foremost a business”. For Smith, the challenge in recruiting the best people varies by geographical and jurisdictional location. Convincing the talent to join a European Union start-up often requires a bit more creativity than it does, say, in Silicon Valley. What needs to be emphasized is the strength of a company’s board, the advisors, and the depth of the investors’ commitment and pockets — all in addition to the demonstrated capability of the technology.

Outlook

University-bred entrepreneurs are spurring scientific and technological innovations in the nanoneedle space; these are now leading to practical and exciting applications in sensing, therapeutic and diagnostic technologies. We have discussed the early evolution of three nanoneedle start-ups: Basilard BioTech, Cytosurge and Aligned Bio. These stories hold important lessons for deciding what to consider when launching a bionanotech start-up, including how to access resources and capital, construct a business model, optimize risk management and gain IP protection.

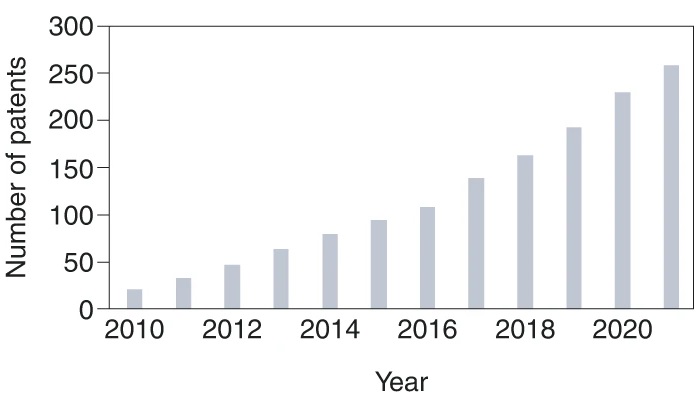

Nanoneedle technology is likely to become a powerful toolkit for the research and medical community. CAR T-cell engineering and molecular diagnostics are beachhead markets where nanoneedles can catalyse translational breakthroughs, and where spin-offs can attract VCs. The number of nanoneedle patents is on the rise, showing that the technology is still fertile ground for new ideas (Fig. 1); but many more nanoneedle start-ups are needed to make the technology mainstream.

Fig. 1: Patent trends. This patent search was conducted using The Lens with the keywords ‘nanoneedle’ and ‘bio’ between 1 January 2010 and 31 December 2021. Patents in the same family (filed with the same title and claims but in different countries/regions) are counted as one to avoid duplicates. The number of patents in each year corresponds to the year of patent publications. Full size image

We believe that universities should devote more resources to integrating the acquisition of entrepreneurship into their undergraduate and postgraduate courses, teaching how to embrace research commercialization from the conceptual stages to translation and, ultimately, end-users. Emerging researchers deserve active support to develop industry-relevant skills in the process of translating their findings, including the culture of entrepreneurship and investment, advanced manufacturing practice, and how to engage effectively with potential players.

Read the original article on Nature.