Nano One Materials Corporation’s (CVE:NNO) (OTCMKTS:NNOMF) patented technology for the low-cost production of high-performance lithium-ion battery cathode materials could lower manufacturing costs for batteries, alphaDIRECT Advisors says.

Shawn Severson, founding partner of the investor-intelligence firm, issued a report on Nano One’s corporate structure, the world-wide lithium-ion cathode industry and target markets, together with key milestones, future opportunities, strategic drivers, financial highlights, peer comparison and risk assessment.

Severson noted that the energy-storage industry, which is growing rapidly, has become “a critical technology” behind a number of industries including electric vehicles, renewables, utilities, microgrids and consumer electronics.

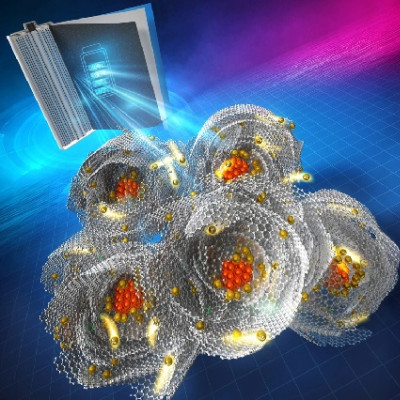

“With the industry driving for lower costs and higher power densities, battery materials are a key consideration,” he wrote. “With the cathode accounting for approximately 27% of the cost of a lithium-ion battery, we believe Nano One is uniquely positioned to enable battery manufacturers and material suppliers to lower costs through a new and innovative cathode processing technology.”

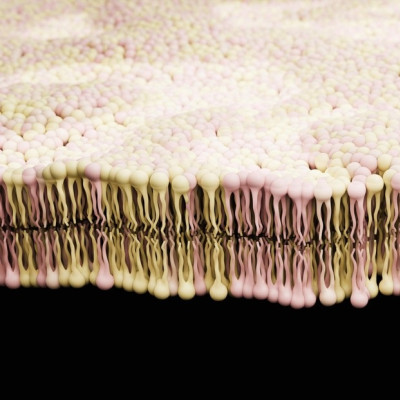

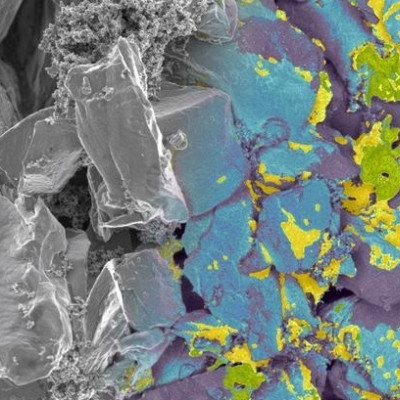

Nano One, based in Burnaby, British Columbia, has developed an industrial process for producing low-cost, high-performance battery materials and a wide range of other advanced nanostructured composites.

And overall, market forecasts project that demand for the cathode materials in lithium-ion batteries will reach US$10 billion by 2025. Severson also pointed out that Nano One has an extensive patent portfolio and a proprietary process that is ready for commercial-scale deployment.

He also said the company has already solidified joint development partnerships with Volkswagen and Saint-Gobain and a collaboration with the Chinese cathode producer, Pulead Technology Industry, which it intends to jointly develop and optimize scaled-up lithium iron phosphate (LFP) production.

“Furthermore, Nano One should have significant margin leverage as it intends to use a royalty model and is asset-light,” said Severson.

alphaDIRECT Advisors creates and implements digital content and programs to help investors better understand a company’s key drivers including industry dynamics, technology, strategy, outlook and risks as well as the impact they could have on the stock price.

Read the original article on Proactive Investors.