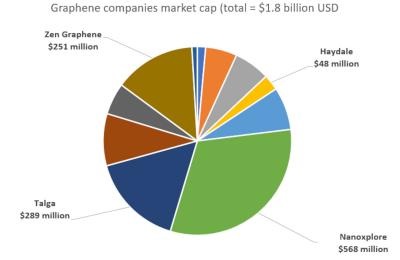

The total market value of graphene companies now reaches $1.8 billion USD for the 13 leading graphene public companies we track. It is important to note that not all this value is directly related to graphene - some of the companies have other activities, mainly graphite mining and supply. But for all these companies, graphene is a major part of the business, and most of the companies are pure-play graphene companies.

In the past few months we have seen several new IPOs (or SPAC mergers) that increased the number of public graphene companies - for example Australia's GMG and UK's Tirupati Graphite.

It is true that the global markets are enjoying a good period in general, but that is not the whole story. More and more companies report larger graphene orders and as graphene adoption is on the rise in meaningful graphene projects, we expect companies to report higher revenues and hopefully finally profits as well. We still think that there may be too many graphene companies out there, and some market consolidation will probably take place in the future.

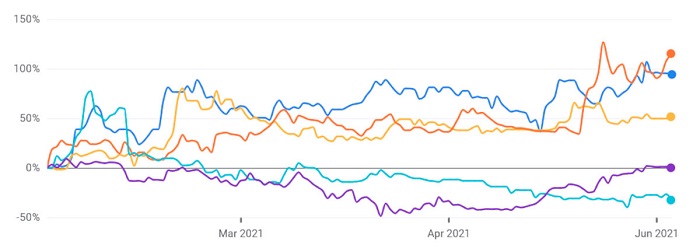

Looking at the companies we track, for some 2021 was a very good year, while others have seen their share price drop significantly. Not all graphene related investments fared well in 2021!

For investors interested in taking part in the growing graphene market, we provide a graphene investment guide, which provides information on leading and small-cap public graphene companies trading all over the world. Our report also includes an introduction to graphene, a look at current market activities and our own investment thesis. Click here if you want to learn more about graphene and how to make wise investment choices in this growing industry.

Read the original article on Graphene Info.