The company aims for a $3 billion valuation, its co-founder Yuri Koropachinsky told Forbes Russia last week. “We’re having very deep discussions with nine SPAC companies,” he said.

SPACs are becoming trendy among Russian-founded tech companies, as witnessed the recent SPAC-enabled listings of Arrival, Nexters and Momentus.

“Compared with the US market, which is nearing saturation, the Eastern European tech field looks almost virgin, offering many opportunities for SPACs to identify targets and merge with them,” an insider told East-West Digital News.

Western listing after Russian state and oligarch backing

When going public, under plans, OCSiAl will float about $15% of its shares. The company aims to raise anything between $300 million and $800 million — “first and foremost, to build a big factory.”

“This is a necessary step given the limitations of our current capacities,” Koropachinsky said in his Forbes interview.

OCSiAl is also in the process of completing two private placement deals totalling $200 million, according to Koropachinsky. This amount is coming on top of an injection of $100 million as part of “a series of rounds” which was closed this past summer at a $2.3 billion valuation. Daikin took part in these deals, contributing $4 million.

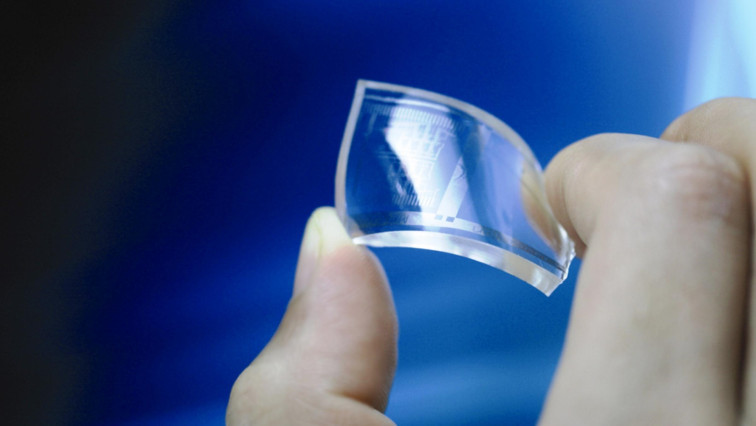

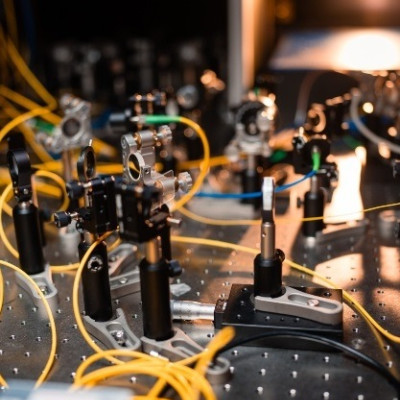

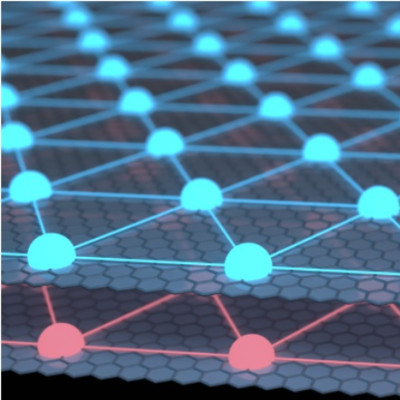

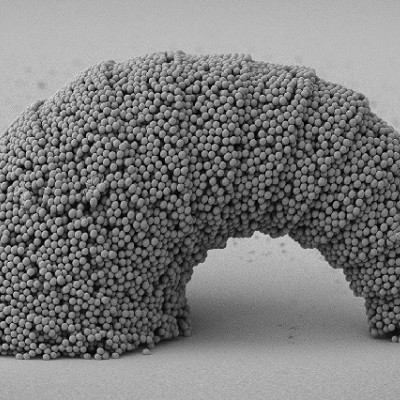

OCSiAl refers to four chemical elements: oxygen (O), carbon (C), silicon (Si) and aluminum (Al). Touted as the world’s only manufacturer of graphene nanotubes at a large scale, this company is the brainchild of Russian physicist Mikhail Predtechenskiy alongside Koropachinskiy and two other businessmen: Oleg Kirillov and Yury Zelvenskiy.

Having established their company in 2010 in Luxembourg, they garnered the support of several Russian investors, including Rusnano, the state-controlled nanotech giant ($60 million invested in 2012 and 2015); individual investor Igor Kim (2013, 2014); Moscow-based PE find Expo Capital (2019); and an undisclosed British investor (2019).

In 2019 A&NN Investment — an investment holding controlled by oligarch Alexander Mamut — put $5 million to acquire 0.5% of OCSiAl, purchasing a fraction of Rusnano’s stake.

Read the original article on East-West Digital News.