Siva Therapeutics holds two patents supporting the in vivo delivery of a thermal therapy, which is being designed to have multiple beneficial effects on tumors, including being more selective than chemotherapy, less destructive than radiation, and without the risks of surgical treatment. Under the Definitive Agreement, Sona Nanotech has agreed to acquire all of the issued and outstanding common shares of Siva with total consideration to the Siva shareholders of US $2.0 million in Sona shares at the date of closing, plus up to an additional US $6.65 million in Sona shares over multiple instalments conditional on Siva's future achievement of specific performance milestones by January 31, 2025.

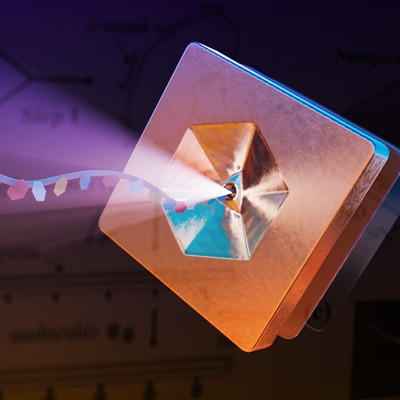

Siva Therapeutics is an Austin, Texas based company established in 2010 that is in the pre-clinical phase of developing THT and the SivaLum™ infrared light device that forms part of THT. Siva has benefited from over US $2.8 million in investment and grant value, in addition to founder contributions.

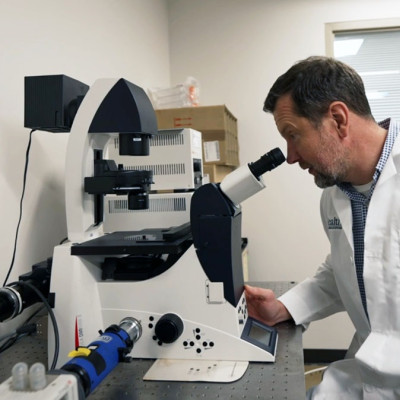

Siva has completed five safety and efficacy studies, including for melanoma in mice and the Nanotechnology Characterization Laboratory (NCL) program. Siva's THT path to market will involve the completion of large animal studies and the filing for an Investigational Device Exemption (IDE) with the FDA in preparation for human clinical studies. Siva's management team has over 50 years of combined life sciences and medical device experience with a track record of prior successful market introductions.

"Having worked with multiple manufacturers of nanoparticles, we were delighted to discover Sona and its unique gold nanorod technology, which we value for its biocompatibility, stability and ability to be produced in-house at commercial scale, all of which are vital to the success of our therapy. This merger is the natural next step in order for us to secure access to the critical material upon which our Targeted Hyperthermia Therapy is dependent." - Len Pagliaro, Ph.D., President and Chief Executive Officer of Siva.

"We are thrilled to be combining with the Siva team given their traction in developing a practical and powerful therapy that leverages the key attributes of Sona's gold nanorods to potentially improve the lives of people living with cancer. This transaction provides for tremendous alignment of interests for the success of the further Targeted Hyperthermia Therapy trials planned for 2023 which will first address colorectal cancer, the second most mortal cancer worldwide, providing Sona with a more diversified portfolio as part of our push to build shareholder value." - David Regan, Chief Executive Officer of Sona.

Pursuant to the Definitive Agreement, the Company has agreed to acquire all of the issued and outstanding common shares of Siva in exchange for the Transaction Shares, to be issued at a deemed value equal to the greater of: (i) the volume weighted average price (VWAP) for the Company's common shares for the ten (10) trading days immediately preceding the fifth business day preceding the Closing Date, and (ii) the maximum allowed discounted price allowed under the policies of the Canadian Securities Exchange.

As additional consideration, Sona may issue additional Performance Shares to the shareholders of Siva in up to four instalments for up to an additional US $6.65 million in Sona common shares, upon Siva achieving the following four milestones:

(a) Upon Siva securing a contract for a large animal colorectal cancer tumor model, suitable for the evaluation of Siva's THT therapy by no later than June 30, 2023, a further US $650,000;

(b) Upon Siva obtaining delivery and acceptance of infrared light devices meeting certain technical and costing requirements, by no later than nine months from the Closing Date, a further US $750,000;

(c) Upon Siva achieving results from a large animal study of THT therapy for colorectal cancer tumors that support an US Food and Drug Administration Investigational Device Exemption for human study, by no later than January 31, 2024, a further US $2,700,000; and

(d) Upon Siva obtaining positive results from the first cohort of a "first in human" clinical study for THT therapy, and a notice of allowance for a patent for the infrared light device to protect THT for colorectal cancer, by no later than January 31, 2025, a final US $2,550,000.

Each of these Milestone payments of Performance Shares will be converted into Canadian dollars on the fifth business day preceding the issue date and will be payable in Sona's common shares at a deemed value equal to the greater of: (i) the VWAP on the fifth business day preceding their issue date, and (ii) the maximum allowed discounted price under the policies of the Exchange based on the closing price of the Sona Shares on the last trading day preceding the announcement of the completion of the Milestone; and provided further that the deemed value must not be less than $0.25, $0.35, $0.50 and $0.75 per share for the first, second, third and fourth Milestones, respectively.

Completion of the Proposed Transaction is subject to the satisfaction of a number of closing conditions, including satisfactory resolution of outstanding Siva stock options, completion of two interim equity financings by Sona, and certain other customary closing conditions, and is subject to review and acceptance by the Exchange. The Definitive Agreement will terminate if the Proposed Transaction is not completed by March 31, 2023, unless extended by mutual agreement of the parties. Sona does not expect the closing of the Proposed Transaction will have any immediate material impact on Sona's financial position.

All Transaction Shares and any Performance Shares issued in connection with the acquisition of Siva will be subject to a four-month and a day hold period from their date of issue under Canadian securities law, and may be subject to a longer hold period for trading in the U.S. Two of Siva's founder's Transaction Shares are subject to further voluntary pooling restrictions with the Company, in respect of 90% of the Transaction Shares of the President of Siva, and 70% of the Transaction Shares of the Vice-President, Legal Affairs of Siva, pursuant to which 20% of the original number of their respective Transaction Shares will become available for sale every 6 months until fully released.

In view of the number of common shares issuable to him, the President of Siva has also agreed that he will not be entitled to receive additional Performance Shares, or common shares of the Company through the exercise of any other convertible securities of the Company, if that would result in him holding 20% or more of the then total issued shares of the Company. As a result, there will be no change in the effective control of the Company.

As contemplated under the Definitive Agreement, Sona intends to first complete a private placement financing to raise up to $500,000 by the issuance of up to 5,000,000 common shares at an offering price of $0.10 per share to fund the continuing operations of Sona and necessary transaction expenses related to completion of the Proposed Transaction while the parties work towards satisfying the closing conditions. The Working Capital Financing is necessary and integral for Sona to be able to complete the Proposed Transaction, but is not contingent upon the closing of the Proposed Transaction. Sona has entered into an agreement with a registered dealer to act as placement agent for the Working Capital Financing, pursuant to which Sona has agreed to pay a cash fee equal to 8% of proceeds raised from investors introduced by the placement agent and to issue compensation warrants entitling the placement agent to purchase that number of common shares as is equal to 8% of the common shares sold to investors introduced by the placement agent. Each compensation warrant will be exercisable into a common share of Sona Nanotech at $0.10 per share at any time for a period of 24 months from closing.

The closing of the Proposed Transaction is conditional upon Sona completing an additional equity raise for gross proceeds of at least US $1.0 million, or any other amount that is mutually agreed by the Parties, which is expected to close by February 28, 2023. The details of this offering will be announced in a later press release, and the net proceeds will be held in escrow pending the closing of the Proposed Transaction.

Read the original article on Newsfile Corp.