You could cram a lot more energy in a lithium-ion battery anode if you replaced the graphite in the anode with silicon. Silicon has about 10 times as much storage capacity.

But silicon bloats during charging, and that can break a battery’s innards. Graphite hardly swells at all because during charging it slips incoming lithium ions between its one-atom-thick layers. That process, called intercalation, involves no chemical change whatever. But it’s different with silicon: Silicon and lithium combine to form lithium silicide, a bulky alloy.

A lot of companies are trying to sidestep the problem by fine-tuning the microstructure of silicon sheets or particles, typically by building things from the bottom up. We’ve written about a few of them, including Sila Nanotechnologies, Enovix Corporation, and XNRGI.

Now comes Advano, a startup in New Orleans, that champions a top-down approach. The point is to produce silicon particles that are perhaps not so fine-tuned, but still good enough, and to produce the little dots in huge quantities.

“We start with bulk material and reduce the size; it’s like grinding, and it’s infinitely scalable,” says Alexander L. Girau, the founder of Advano, which is just emerging from stealth mode. “True, you get a wide distribution of sizes; it’s not as controllable as a bottom-up process, where you start with a gas or liquid and then make it self-assemble. Again, that would be a beautiful, finely tuned material. But how the hell do you scale?”

Scale is everything in a materials company, and materials is what Advano is all about. It doesn’t manufacture batteries or even anodes, except for a limited number, which it uses for research. What it focuses on is silicon particles, and it can make them by the ton.

“We have a production capacity of a ton per year, and we’re finishing a facility that should give a minimum of 10 tons,” Girau says. “We could scale up to thousands of tons. That’s peak production capacity—we actually make kilograms per day, which is what customers want to test.”

A thousand tons of silicon is barely enough for lithium-ion batteries that store 5 gigawatt hours. A BloombergNEF study projects that installed electric storage capacity in vehicles and in fixed installations will rise to 4,600 GWh by 2040, up from just 17 GWh in 2018.

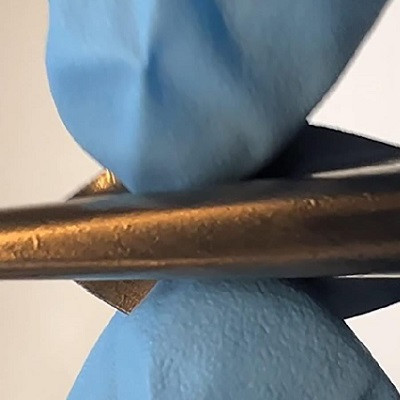

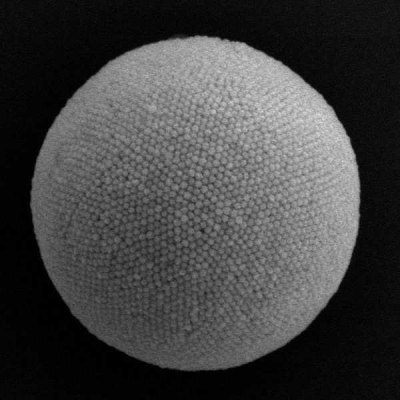

The bulk material from which Advano starts is repurposed silicon, say from solar panels. It processes this into silicon nanoparticles, then incorporates the particles into a micron-scale carbon matrix. Chemical treatment causes fibers of silicon carbide to grow from within each particle outward, creating a kind of peach fuzz on the surface. The fuzz links up with the fuzz on other particles, providing mechanical support.

“It looks like graphite, and we can process it like graphite, but it has silicon on the inside,” says Girau. “And we protect the silicon surface from degradation.”

A battery maker could take the powder and introduce it into graphite anodes at various concentrations. The higher the concentration gets, the greater the storage capacity will be.

“For a faster charge rate, we bake it more, to make it more conductive,” Girau says. “Of course, you’re always trading off something—we don't know all the tradeoffs because we haven’t had to do it yet. Baking it more would take more energy, and that would make it a little more expensive.”

Different customers would use different proportions, depending on the specification they’re trying to optimize for—sheer capacity, cycle life, or safety. For instance, if a customer needs the battery to last for 1,000 charge-recharge cycles without resorting to cooling, the silicon could make up 15 percent of the anode, Girau says. But for certain applications in consumer electronics that might need a battery with only 250 charge-recharge cycles, it’s possible to go to 70 percent silicon, or even higher.

Going to full silicon anodes should, by itself, yield a 40 percent improvement in storage capacity. You can do better still by also redesigning the cathode and the other parts of the battery.

Advano is a small company, with just 20 employees, and it initially raised just US $12 million, not a large sum in this industry. In September it partnered with Mitsui, a Japanese battery materials company that supplies top Japanese OEMs.

Smallness has its advantages, Girau suggests. “We can move faster. Frankly, a lot of battery companies are more concerned with growing existing battery factories; they’d rather invest in startups than do it themselves.”

Read the original article on IEEE Spectrum.