At the recent MEMS World Summit Webinar, Anil Narasimha, co-founder and CEO of biotech startup Mekonos, and Anil Achyuta, an investment director and founding member of TDK Ventures, explained the beautiful and beastly aspects of starting a MEMS-based health-tech business, describing the experience from their respective perspectives as entrepreneur and investor.

The entrepreneur

The delivery of molecules into fragile cell types remains complex, especially for applications such as cell and gene therapy. Challenges include a lack of precision and automation that makes these therapies overly expensive to develop. Silicon Valley–based startup Mekonos has developed a platform leveraging microelectromechanical system technology to add a layer of automation and precision to the drug development pipeline.

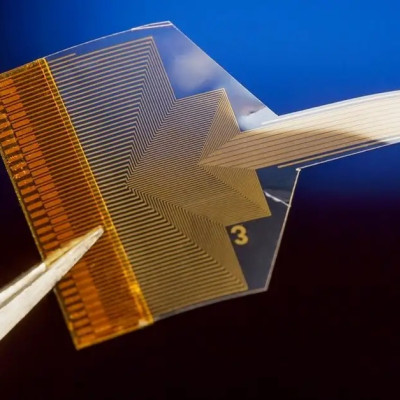

As part of the ideation process, Narasimha said, the Mekonos team pondered how it could “utilize MEMS technology as an integral component to a platform to automate ex vivo delivery of molecules or payloads into cells, especially fragile cell types that are inherently hard to manipulate.” Using actuated nanoneedles, the startup is able to inject single cells with a specific payload with high efficiency and cell viability, he said. “Applications are numerous, but our focus has been in the cell- and gene-therapy personalized-medicine space. Our vision is to make personalized medicine more accessible to the mainstream population.”

Narasimha founded Mekonos in 2017 after completing his Ph.D. at the University of California–San Diego and moving to Stanford University to become a postdoctoral fellow in Michael Snyder’s laboratory. In his talk, he shared some of the challenges he has faced during his entrepreneurial journey.

Finding the right associate and adviser

As a biologist, Narasimha had envisioned the target application, but it was not his idea to use nanoneedles. “Luckily, my co-founder [Steven Banerjee] is a mechanical engineer who was working on nanoneedles,” he said. At Stanford, “we had this idea of using nanoneedles for a biological application and thought, why not for delivery?”

Prior to co-founding Mekonos, Banerjee had worked on the IBM Millipede project, which used an array of thousands of miniaturized atomic-force microscopes as a memory device. He is now the founder and CEO of NExTNet, a startup building an AI-powered, graph-based big-data analytic infrastructure to accelerate the discovery and development of biomedicine.

Narasimha said he was also fortunate to have had the support of Stanford’s Irving Weissman, who told him that if he could deliver DNA, RNA, and CRISPR molecules or payloads in a stem cell using this technology, it would be “a game-changer,” and Narasimha “should start a company.”

Weissman has a long and respected track record in stem cell biology. He is the director of the Stanford Institute for Stem Cell Biology and Regenerative Medicine. Weissman is also Virginia and D.K. Ludwig Professor for Clinical Investigation in Cancer Research and a professor of developmental biology at Stanford University School of Medicine, and he has founded several companies focusing on stem cell therapies.

“If someone like Irving says something like that, you’ve got to take it seriously,” said Narasimha. He promptly dropped his postdoc ambitions in order to demonstrate the feasibility of the technology and launch Mekonos.

Defining the business model

When asked about the hardest decision he’s had to make during his entrepreneurial journey at Mekonos, Narasimha acknowledged that developing the technology has been a challenge but said developing the business model has been even more challenging.

Mekonos has designed a system-on-chip that combines three elements. The first element is a proprietary microfluidic chip that traps single cells into specific nodes. The second is a nano-engineered silicon MEMS. Controllable nanoneedles directly address the trapped single cells, and each nanoneedle delivers the payload inside the cell. The third element is surface chemistry to provide a more robust and versatile solution.

“Because we went the solid needle route, we had to develop the surface chemistry to basically facilitate attraction of a payload onto the needle and the release of the payload once the needle is inside the cell,” Narasimha said. “The crux of our platform is the combination of these three elements working in synchronicity to deliver any kind of payload into any kind of cell type.”

There are very few MEMS companies in the cell- and gene-therapy space today, and Mekonos claims it is the only one to offer a solution for controlled and individualized molecular delivery in cells. “Being in that unique situation, we have to be really careful with our business model,” said Narasimha. “We are introducing a new technology, so if we come up with a new business model, that’s going to scare off not only potential customers but investors as well.”

Narasimha said Mekonos is still working on the definition of its business model. “We have the strategy of being an enabling company for biotech pharma companies and demonstrating our value in multiple applications within those drug development pipelines,” he said, but “how do we maximize our value?”

Hiring experts

Mekonos brings together a team of experts from Stanford, Berkeley, MIT, and Purdue. Still, Narasimha said he finds it complex to hire the right technical expertise, especially people who are passionate about biology. Finding talent in biology and talent in MEMS technology is one thing; finding people with this dual skill set is another. “MEMS is a field in itself, so transposing that [knowledge] into the health-care cell- and gene-therapy world is almost foreign [territory]. These people [MEMS specialists] aren’t used to that, and that’s a big challenge for us.”

Finding the right investors

One of the most difficult aspects of starting a business is determining which investors can add the most value. Not all venture capitalists play an equally active role in supporting their companies. “Finding the right group of investors is a no-brainer,” said Narasimha, adding that the right investors are those who “believe in you, in your team, and in your technology” and who understand the industry and its dynamics.

On the technology side, Mekonos had conversations with TDK Ventures about the platform development, the MEMS foundry ecosystem, and the entrepreneurial process. On the biology side, it could notably count on health-care group Novartis.

Finding the right balance is “really important, especially for a first-time founder like myself,” said Narasimha. “I don’t have the ability to go off with my previous experience in the entrepreneur world and say that I know how to do this, what works, and what doesn’t. If you can identify that set of advisers and investors early on, they can help you out tremendously.”

In November 2021, Mekonos raised US$25 million in a Series A financing round co-led by Reimagined Ventures, Fiscus Ventures, and Peak6 Strategic Capital. The round also included new institutional and strategic investors such as Section 32, Sands Capital, TDK Ventures, the venture arm of Debiopharm, and previous investors such as Novartis Pharma AG and Elementum Ventures.

The investor

Established in 2019, TDK Ventures is a wholly owned subsidiary of TDK Corp. Since co-founding TDK Ventures, Achyuta has reviewed more than 1,800 startups and invested in 11. Besides Mekonos, three are in the health-care sector: Genetesis, a magnetic-imaging–based cardiac diagnostics company; Exo, a developer of handheld 3D ultrasound imaging technology; and Mojo Vision, an augmented-reality contact-lens company.

Achyuta shared some insights from his venture experiences.

Where to invest?

That’s a tricky question, and returns are never guaranteed. It is possible to lose the entire investment, Achyuta noted. “We only invest when we have deep insights … when we know we can bring tangible value to the startup,” he said.

In April 2021, TDK Ventures closed a US$150 million fund for early-stage investments in clean technology, advanced materials, industrial, robotics, energy, autonomous vehicles, electric vehicles, and health-tech segments. TDK Ventures’ total assets under management are now US$200 million.

Out of the first fund, TDK Ventures has made 15 investments and reported two M&As, one IPO, and one unicorn. The second fund has a portfolio of eight companies, and the checks range from US$250,000 to US$5 million.

It goes without saying that TDK Ventures examines the growth potential of a candidate for funding, as any venture capitalist would. The cell- and gene-therapy market, for instance, is projected to grow rapidly, reaching sales forecasts of €27.9 billion by 2026, according to consultancy firm Roland Berger.

“I think every investor in health care should be looking at that market because it is growing at an incredible pace,” Achyuta said.

When to invest?

Determining at what stage of the startup’s development it is best to invest to ensure an optimal return on investment is no easy task. “Do I invest when they come out as a startup, or do I invest when they go to mid-scale, or do I invest in a later stage?” asked Achyuta. “It’s always a difficult situation for me, because there is a lot of risk in translating these technologies from low volume to medium volume and high volume.”

What’s the clinical value?

For health-tech startups, the main challenge is the demonstration of the technical and clinical feasibility of the proposed concept, product, or service. “I see a lot of these CGM [continuous-glucose–monitoring] companies and blood-pressure–monitoring companies that show up with very good initial data but have no clinical evidence whatsoever,” said Achyuta. “It’s difficult to kind of jump the gun and say, as an investor, ‘I want to put my money into that.’”

For MEMS-based wearable startups that are willing to sell smartwatches, the main question is how they can compete with Apple or Samsung. For health-care startups, however, the questions are: What is the clinical value? How do you justify the technology?

“If startups show up with a pilot study of 20 patients, it will give the investors much more confidence than showing up [with only] the prototype,” said Achyuta. “Starting a company has become so easy — and early capital seems to be flowing everywhere — that showing up [with] a prototype seems to be much easier than it was five to 10 years ago.”

The risk is that investors will adopt a more conservative posture and seek even more guarantees. “Many of my medtech [investor] friends are moving post-FDA. They say, ‘I will not invest until I have FDA or CE mark clearance,’ and that’s really hard on startups. Where do they get the capital to get there?”

Is the FDA clearance enough?

It is commonly thought that FDA clearance is the key milestone for finalizing the product’s development and launching the product commercially in the U.S. Achyuta confirmed that FDA clearance is necessary but added that it isn’t sufficient. “There are many companies out there that have received an FDA clearance, but really, it means very little” on its own, he said. “In fact, the reimbursement — how you [get] traction and how you convert that [approval into a] business — is much harder to do.”

Read the original article on EE Times Europe.