Aerogels – often supplied for high temperature insulation as nonwoven blankets – have experienced steady market growth historically, reaching a market of just under US$450 million in 2022, according to a new report from IDTechEx.

Progress has been slower than expected largely due to competition with lower-cost incumbent insulation materials. The emergence of aerogels as a fire protection material for electric vehicle (EV) batteries provides a new and rapidly growing opportunity for the aerogel market. The IDTechEx report, Aerogels 2024-2034: Technologies, Markets and Players, predicts that EV batteries will account for over half of the aerogel market by 2025.

Thermal insulation

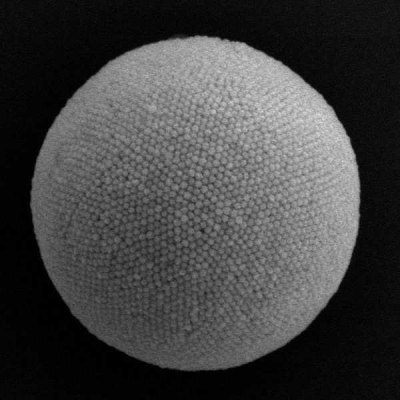

Aerogels are well known to exhibit excellent thermal insulation (15-20mW/m.K) making them ideal for EV batteries.

Typically, battery cells are cooled via a thermal management strategies like water cold plates and coolant channels. However, around these it can be beneficial to thermally insulate the cells from each other. This aids in keeping cells warm in cold conditions and prevents heat transfer between cells in the event of an overheating cell. Aerogels also have a very low density (<0.2g/cm3), which aids in the energy density of the pack.

One of the limitations to aerogel adoption in EVs has been the lower maximum burning temperature. With OEMs looking to provide safety in a thermal runaway event, aerogel manufacturers now largely suggest their materials will provide protection well above 1000°C.

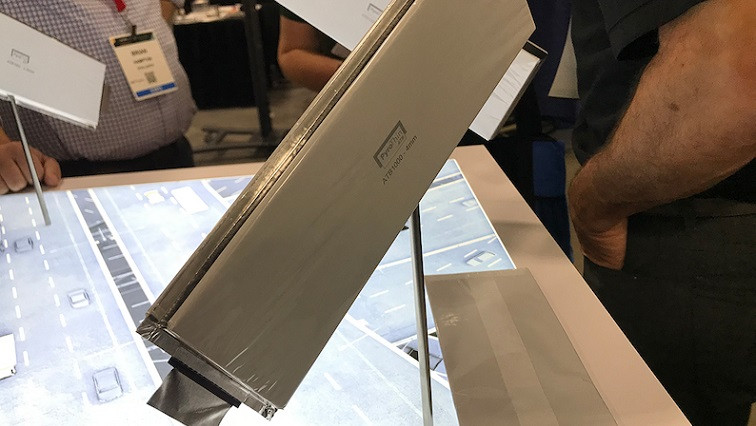

Another concern has been the handling of these materials and their ‘dusty’ nature. In order to combat this, several aerogel manufacturers provide their EV products in the form of encapsulated pouches, allowing for direct integration into the battery.

As with everything automotive, cost has been a barrier. This can be somewhat mitigated by the fact that aerogels can provide multiple properties. As EV battery packs tend towards higher energy density through greater integration, multifunctional materials take focus. Aerogels can provide thermal insulation, electrical isolation, fire protection and some compression performance. Additionally, as manufacturing scales up and orders reach higher volumes, there is potential to bring the cost down to further compete with alternatives.

Competition

Commonly used fire protection materials include ceramic blankets, mica sheets and foam encapsulation. There are a host of other materials that aim to compete in this space, too, including intumescent materials and phase change materials. Each has its own trade-offs in terms of core properties like thermal conductivity, density, compression performance, maximum protection temperature, sustainability and more. The specific battery design will also impact choice, for example, the cell format (pouch, prismatic, cylindrical) and pack structure (cell-to-pack, thermal management strategy etc.).

IDTechEx finds that several options will continue to present opportunities, with no single solution predicted to completely dominate the market within the next 10 years.

Most of the early aerogel progress in the EV market was within China for electric buses. Now the market leader, Aspen Aerogels, based in the USA, has made significant progress. The revenue generated from its PyroThin EV material climbed to $55.6 million in 2022 – times its 2021 value. Aspen has been awarded orders from GM for its Ultium platform and for Toyota and several others.

China has the majority of the overall aerogel manufacturing capacity. A key player for EVs is IBIH, which with its first production in 2017 doubled capacity by 2023, with further expansions underway.

IBIH sells the majority of its products to top EV battery makers and informed IDTechEx that it has doubled revenue each year since 2020. The Chinese market also has many other aerogel players, most of which are fairly young companies and at varying stages of production and EV involvement.

The aerogel market has grown at a steady rate, but EVs will cause the market to grow rapidly, with IDTechEx predicting the total aerogel market will exceed $2.6 billion by 2034, with the vast majority taken by EV batteries. Several other materials will compete in this field, but aerogels are set to become a standard option.

Read the original article on Innovation in Textiles.